TotalSig makes managing Bitcoin multisigs simple and easy. There's no need to spend hours searching for new solutions and grappling with complex processes when you can achieve it with just one click. Bitcoin multisigs are finally here, enhancing your team's business operations with security and convenience.

Download Bitcoin Wallet

Bitcoin multisig wallet tutorial

Bitcoin MultiSig Fees

Operation costs

TotalSig

0.14 USD 43%!

Other multisigs

0.24 USD

Totalsig reduces operational costs by eliminating the need for complex P2SH wallet scripts. Previously available only to large institutional players, Totalsig now makes MPC technology accessible to everyone.

Why There is Price Difference?

Unlike other solutions that rely on smart contracts, which are known for their complexity and high costs, TotalSig utilizes MPC multisigs. This innovative approach is increasingly adopted by leading institutional players, offering a significant reduction in multisig expenses and improving the user experience.

On the Bitcoin network, MPC multisigs are more cost-effective compared to traditional P2SH multisigs. This is because they require only one signature per input, which avoids the need for multiple signatures that typically incur higher network fees. This streamlined approach not only reduces costs but also simplifies transaction processing on the Bitcoin blockchain.

Why Use BTC Multisig Crypto Wallet

Increased Security

Traditional wallets rely on a single access point, which, if breached, leaves funds vulnerable. Multisig wallets elevate security, necessitating multiple private keys for transactions. A fortified barrier, it substantially reduces the chances of unauthorized access and fund theft.

Risk Mitigation

In traditional single-key systems, if a key holder is unavailable, it can disrupt operations. Multisig addresses this risk. With multiple key holders, transactions proceed without delay, ensuring smooth business operation.

Bitcoin multisig wallet for businesses

In instances where assets need collective decision-making, multisig wallets shine. By distributing control among several parties, it mandates consensus for transactions, ensuring that no single entity holds unilateral power, fostering collaboration and mutual trust.

Decentralized Organizations

Embracing the ethos of decentralization, multisig wallets cater perfectly to decentralized autonomous organizations (DAOs). With no central authority, these wallets empower collective management, ensuring that decisions and transactions echo the shared values and visions of its members.

BTC Multi-signature Wallet Features

Free multisig wallets

TotalSig is a comprehensive multisig wallet designed to enhance the security of your digital assets. It supports BTC, the principal cryptocurrency of the Bitcoin network, offering robust protection for your transactions and holdings.

Best fee calculator

TotalSig provides a premium fee calculator designed to ensure you pay the least possible fees. Unlike other wallets that might place a lower priority on fee optimization, leading to possible overpayments by two to three times, TotalSig prioritizes cost efficiency, especially beneficial for Bitcoin transactions.

About Bitcoin

What is Bitcoin?

Bitcoin is a decentralized digital currency, introduced in 2009 by an entity under the pseudonym Satoshi Nakamoto. As the first cryptocurrency, Bitcoin paved the way for a myriad of other digital currencies. It operates on a peer-to-peer network, where transactions are verified by network nodes and recorded on a public ledger called a blockchain.

Bitcoin ecosystem

Background

Bitcoin was created as an alternative to traditional currencies and a means to effectuate transactions without reliance on centralized financial institutions. Officially released in 2009, it has remained the most prominent cryptocurrency, emphasizing the concept of decentralized financial sovereignty.

Purpose

The primary purpose of Bitcoin is to enable secure, private transactions across a decentralized network. This system offers an escape from governmental oversight and financial institution control, promoting monetary independence and privacy.

Coins

Bitcoin is not only a unit of currency but also a means of transferring value across the Bitcoin network. The network's security is maintained through a proof-of-work consensus algorithm, which also serves to release new bitcoins into circulation at a predictable rate.

Types of Bitcoin wallets

Choosing the ideal Bitcoin wallet involves weighing various options tailored to different preferences for security, convenience, or both. Each type offers unique features and caters to specific needs.

Hardware wallet

Hardware wallets are the pinnacle of security within the Bitcoin storage options. These physical devices store Bitcoin's private keys offline, protecting them from online threats. Transactions require the device to be connected physically to a computer or smartphone, which ensures a secure yet user-friendly transaction process, typically secured by a pin or password.

Although offering enhanced security, hardware wallets also come with issues of cost and convenience. The need to connect the device physically for transactions may be inconvenient for users who need frequent access to their assets. Additionally, the price of these devices can vary, possibly making them less accessible to some individuals.

Web wallet

Web wallets offer the highest level of convenience in the Bitcoin wallet ecosystem, accessible via browser extensions or websites. They simplify the setup process to just creating an account and setting a pin, ideal for users who prioritize ease of access and frequent transactions. However, the inherent online nature of these wallets makes them more vulnerable to cyber-attacks.

The centralized storage of keys on servers can be particularly risky, and users of custodial web wallets, which manage private keys on the user's behalf, must be wary of security risks.

Desktop wallets

Desktop wallets strike a balance between accessibility and security, installed as software on the user's own computer. They store private keys on the device, providing a secure environment when the computer is offline, similar to hardware wallets. Yet, the necessity for an internet connection to perform transactions introduces potential vulnerabilities, such as exposure to viruses or targeted hacks.

Despite these risks, desktop wallets can be highly secure when used properly, keeping the computer offline except for necessary transactions. Examples of such wallets include Bitcoin Core and Electrum, which demonstrate how desktop wallets can combine robust security with user-friendly interfaces.

Trusted reviews

“Excellent Security for Bitcoin”

TotalSig has revolutionized how our team manages Bitcoin. The multisig features provide peace of mind by ensuring that no single point of failure exists. It's a must-have for any serious crypto operation.

“Best Multisig Solution”

The fee calculator alone saves us hundreds of dollars. The interface is intuitive and makes managing multisig wallets efficient and stress-free. It's easily one of the most useful tools in our crypto stack.

Frequently Asked Questions

A Bitcoin multisig wallet, also known as a multi-signature Bitcoin wallet, is a type of wallet that requires multiple private keys to authorize a transaction. Instead of relying on a single key, it distributes control among two or more participants, enhancing both security and accountability. It's ideal for shared control of funds or organizational use.

To understand how multisig wallets work, think of a Bitcoin shared wallet like a joint bank account. A transaction can only be approved when a set number of private keys agree (for example, 2 out of 3). This collaborative signing process ensures no single person can move funds alone, adding layers of security and reducing risk from compromised devices.

A secure Bitcoin wallet using multisig is far safer than a standard single-key wallet. With a multisig vs single-key wallet, the key difference is that no one key alone can move funds. This protects against theft, loss, or compromise. Whether for individual use, teams, or inheritance planning, multisig adds fault tolerance and peace of mind.

The most popular configurations include the 2-of-3 multisig setup, where two of three keys must sign a transaction, and the 3-of-5 multisig wallet for higher redundancy. These setups balance usability and security, making them common for families, DAOs, and teams managing Bitcoin.

Yes, a hardware wallet multisig setup is one of the most secure configurations. You can use devices like Ledger multisig or Trezor multisig in a multisig wallet for cold storage. These devices store keys offline and can be combined with software wallets to build a decentralized, air-gapped approval system.

Absolutely. A non-custodial multisig wallet means that you (and not any third party) retain control of your keys. Even though keys may be shared across devices or users, no outside entity can access your Bitcoin. This aligns with Bitcoin security principles: trust no one, verify everything.

To recover a BTC multisig wallet, your wallet must be set up with redundancy (e.g., 2-of-3). If one key is lost, the other valid signers can still authorize transactions. Bitcoin key recovery plans may include offline backups, distributed key shares, or inheritance planning to avoid permanent loss. We also provide a recovery script in case you want to recover the original private key. Note that in this case, a single private key would be able to access all wallet assets.

Follow Bitcoin security best practices for a secure BTC multisig setup. Use hardware wallets,

geographically separate your keys, keep backups encrypted, and never store all keys in one place. Add co-signers

you trust, and consider using passphrases or encrypted USBs to further protect access.

TotalSig also supports multisig wallets on other blockchains such as

Ethereum Multisig Wallet and

Tron Multisig Wallet, along with many others —

all through a unified, easy-to-use interface. This makes it simple to manage multisig setups across multiple networks

without compromising on security or usability.

Yes, a Bitcoin escrow wallet or business multisig wallet is one of the most common use cases for multisig technology. In a business setting, multiple team members can co-sign transactions, reducing the risk of internal fraud or mistakes. For escrow, a third-party co-signer can mediate transactions between two parties, ensuring funds are only released when both sides agree. This setup increases trust and security in high-value Bitcoin transactions.

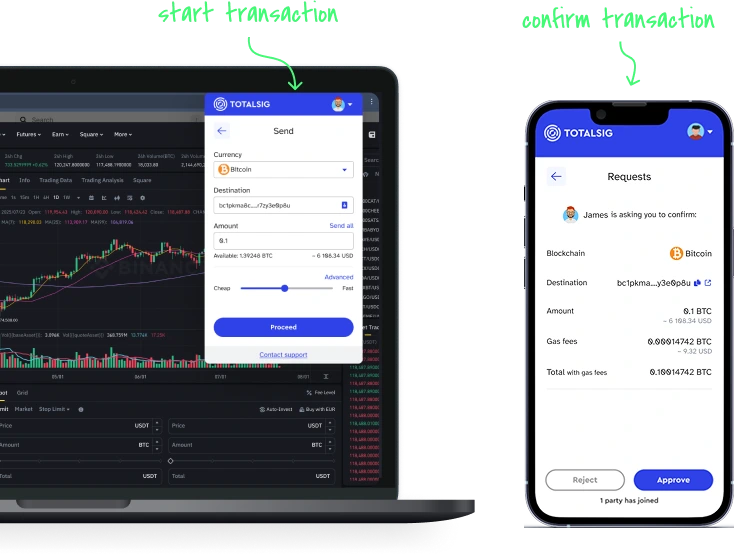

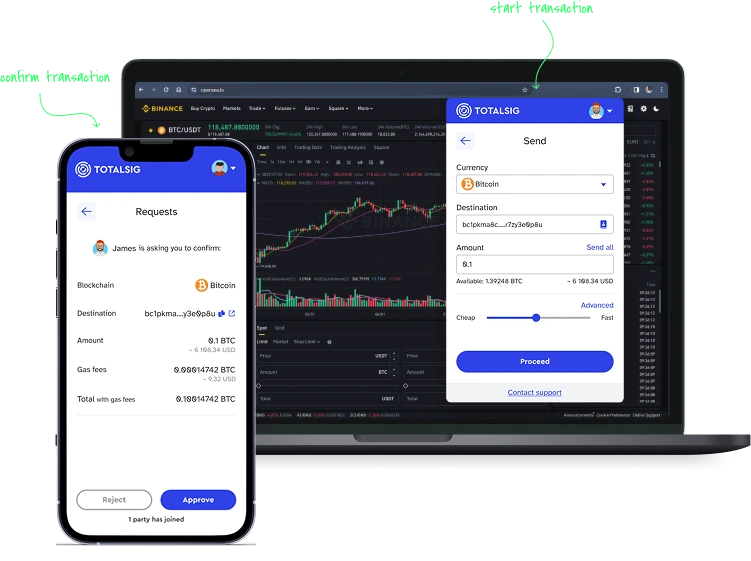

Here's how to create a Bitcoin multisig wallet< in just a few steps using TotalSig:

1. Download the Bitcoin multisig app (TotalSig extension)

2. Create your account and choose a signature policy (e.g., 2-of-3)

3. Add your co-signers - they can join via secure invitation

4. Set up your wallet and test a Bitcoin multisig transaction to confirm

This is one of the easiest ways to setup a BTC multisig wallet securely, even for beginners.

You get advanced protection with an intuitive interface - no technical background needed.

Have more questions? Visit out Docs